Your privacy

The cookies that are used on this web site are collecting statistics and measuring the amount of users and page views on the site. They are not personalized and can not be connected to any users identity.

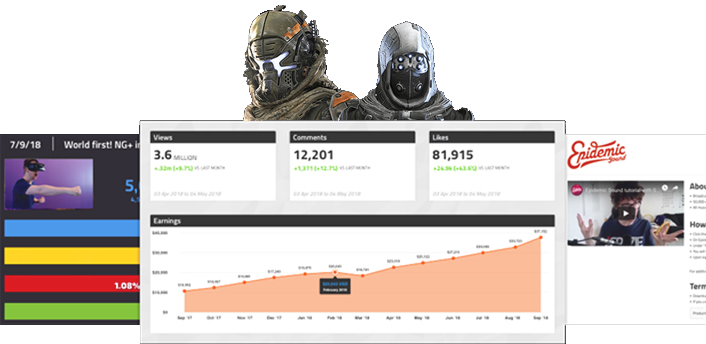

M.O.B.A. Network acquires, develops and operates gaming communities for the global gaming market. We own one of the world’s largest networks in gaming communities, with 23 web-based global brands and the YouTube network Union For Gamers (UFG) with over 1,000 content creators

We offer communities to core gaming fans to craft strategies and sharing ideas with other passionate gamers. M.O.B.A. Network operates a total of 23 global communities on its own platform.

Gain access to an unmatched toolset, cross-plattform exposure and a bigger paycheck for the content you create. You receive 90% of the money your YouTube channel earns.

M.O.B.A. Network´s world class gaming content and communities entertains a global audience with millions of dedicated gamers.

Communicate your brand with our premium audience in our brand safe environment, whether it is thru traditional rich media, display or custom video campaign solutions

Gaming communities

page views per month

content creators

video views per year

Stockholm,

Birger Jarlsgatan 2

Sweden

Vancouver,

British Columbia,

Canada

Las Vegas,

Nevada,

U.S.A

The cookies that are used on this web site are collecting statistics and measuring the amount of users and page views on the site. They are not personalized and can not be connected to any users identity.